Dividing Retirement Accounts at Divorce- The Basics

- Kristyn Carmichael

- Apr 22, 2022

- 3 min read

During a divorce or legal separation, often retirement assets are treated as part of the marital property to be divided. These retirement assets can include pension, IRA, 401(k), 403(b), 401(a), Thrift Savings Plan (TSP), and more. In order to make decisions as to how these assets will be divided, you first need to understand the basics of retirement assets at divorce.

1) Type of Account.

There are a wide variety of retirement accounts and they each have their own implications upon being divided. Generally speaking, there are three types of accounts:

Each account requires different requirements for its division, as well as when the money will be available for use.

2) Who is Who?

A retirement asset is owned by one spouse, commonly known as the “Participant.” The Participant has accrued the funds in the account. For example, if Jennifer has a 401(k) through her employer or an IRA she opened in her name, she is the Participant.

The partner or person sharing in the benefit of the retirement asset is the “Alternate Payee.” This is the person who part of the retirement asset will be assigned or awarded to. For example, Jennifer’s partner Claire could be the Alternate Payee of Jennifer’s 401(k) or IRA.

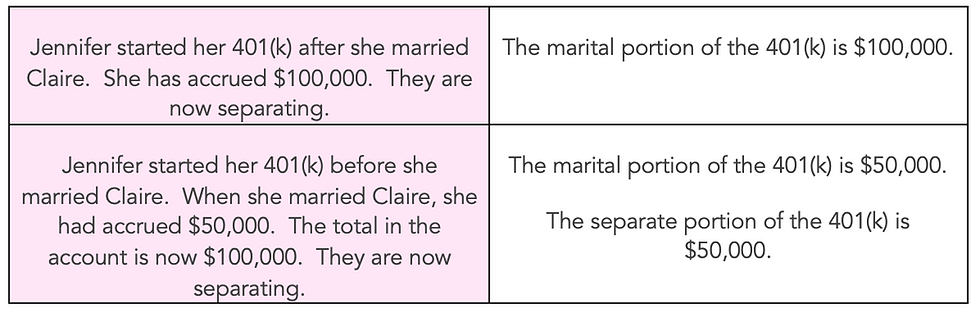

3) What portion is shared?

Generally speaking, the amount of the asset that was accrued, or added to the asset, during the marriage is the portion that would be shared. It may be referred to as the “community” or “marital” portion of the asset. If a portion of the asset was accrued prior to marriage, this will likely be the separate property of the owner of the asset (Participant).

4) Rules and Laws.

Different rules and laws apply to different types of retirement assets. They vary depending on whether the asset is private (held by a private banking institution or employer), state (your employer is the state), federal (your employer is the federal government), or military (you are employed in the military).

It also depends on the specific rules or laws of your state. Each state will have its own perspective on how and when a retirement asset can be divided. Even on a federal level, the division of retirement accounts is dictated by laws. Check with your divorce professional to better understand your specific retirement assets.

5) Division.

A retirement asset can be divided in a number of different ways. Generally speaking, an asset can be divided by:

Splitting the account itself with a court order

Trading the retirement asset for another asset (watch out for liquidity and taxes)

A valuation of the account and a buyout (most common for a pension, but not precise)

6) Disclosure.

It is critical that you and your partner both disclose any and all retirement assets during the beginning of your separation process, before any agreements are reached. This should include the type of account, its current value, whether you still contribute to it, whether it was started prior to marriage, who owns the account, and what financial institution (bank, credit union, etc.) holds the asset. Without this information, neither you nor your partner can make an educated decision as to how they will be split. Disclosure is typically a requirement under state law during a divorce or legal separation process.

7) Timeline.

The division of a retirement asset may require additional documentation beyond your divorce decree or order. Sometimes a QDRO (Qualified Domestic Relations Order) or similar document is necessary. Speak with your divorce professional to determine if you need a QDRO is your specific situation.

In either instance, your decree or order should be signed by a Judge prior to the retirement asset being divided. In almost every instance, a retirement asset is not divisible without a court document…. at least not without tax or fee implications. The sooner these documents are completed, the sooner you can divide the account. Please note, these documents are typically completed at or near the end of your divorce or legal separation process.

Once the documents are completed and submitted to the institution that holds the retirement account, it will be divided by a “Plan Administrator.” This person or group of people facilitates the division of retirement assets. For example, if you had a 401(k) that was held by Fidelity, the Plan Administrator for Fidelity would assist in dividing your 401(k) per the instructions provided in your court order or decree.

It typically takes time for a Plan Administrator to divide an account. It will not be instant and could take up to several months before it is divided.

Comments